This proposal effectively ends the income tax exclusion for appreciated assets passed through an estate. The donor or deceased owner of an appreciated asset would realize a capital gain at the time of the transfer. The proposal would treat transfers of appreciated property by gift or on death as realization events. Appreciated Assets Passed By Gift or Through an Estate.

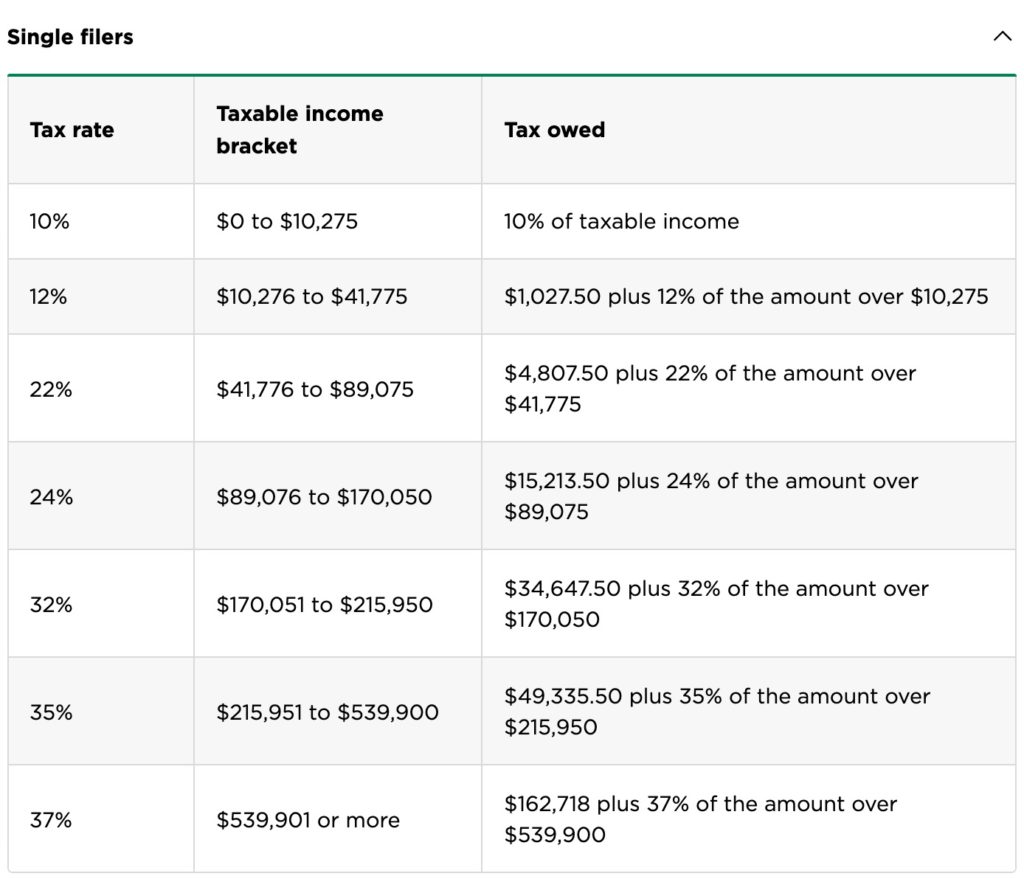

The Green Book says this: “This proposal would be effective for gains required to be recognized after the date of announcement.” That income amount would be indexed for inflation after 2022.Įxample: A taxpayer with $900,000 in labor income and $200,000 in capital gains would have $100,000 of capital gains taxed at the current preferential tax rate and $100,000 taxed at ordinary income tax rates.Įffective Date: The effective date would be retroactive to April 28, 2021, the date President Biden first unveiled his proposals. This change would only apply to the extent that the taxpayer’s income exceeds $1 million.

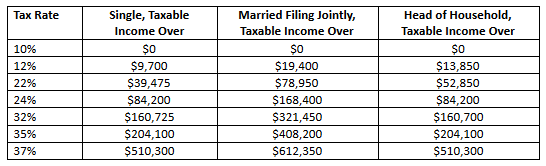

Let’s first look at the Biden Administration’s proposed changes, as explained in the recently released “ Green Book”, the explanation of the Administration’s 2022 revenue proposals. A retroactive change may be hard to get through congress because capital gains rates have been consistently low for a while, but it is still possible an increase could take effect for all or part of 2021. Looking at this proposed change in the context of past changes shows that both Democratic and Republican presidents have signed legislation with retroactive tax provisions. President Biden’s proposal to increase the capital gains tax has generated tremendous discussion. Technology Governance & Optimization Back.Environmental, Social and Governance Back.Research & Development Tax Credits Back.Employee Retention Tax Credit (ERTC) Back.Once you have entered the details about the asset and your income, you can click Calculate to see how much you will need to pay in Capital Gains Tax. For example, if your asset is a property, this may include marketing for sale or renovations, which will be used to calculate your final capital gains amount. Total Costs of Purchasing, Owning and Selling the Asset - This is the amount you have personally invested into the asset before sale.a capital gains amount could force you into a higher tax bracket. It's important to note that any capital gains amount will be added to your current income before calculating the tax rate - i.e. This will help determine the tax rate at which the capital gain on your asset will be taxed. Current Taxable Income - Your current taxable income.Sold Price - How much you have sold the asset for.Length of Ownership - Whether you have owned the asset for less than 12 months or longer than 12 months.Purchase Price - How much you purchased the asset for.To use the Capital Gains Tax calculator, you’ll need to enter some details about your asset.Ĭapital Gains Tax is applied against investment property, Shares, Gold, Cryptocurrency, essentially all assets.

0 kommentar(er)

0 kommentar(er)